In accounting, asset increases are recorded with a debit. Transfers from one cash account to another are also recorded in the same category, but in separate sub-accounts. Cash assets will decrease and equipment assets will increase. A business may decide to use money to buy equipment. Increases and decreases of the same account type are common with assets.

PLAY BOOKKEEPING APP ENTRIES HOW TO

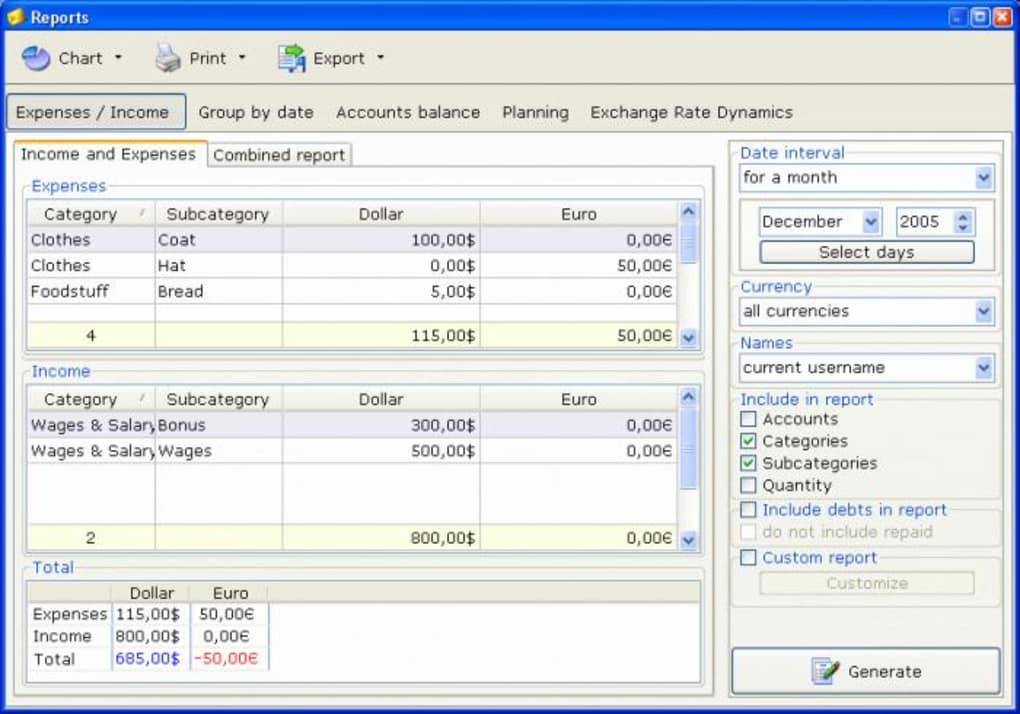

How to increase and decrease different account types Revenue and expenses make up the income statement and can generally be expressed as Revenue – Expenses = Income or Loss. Assets, liabilities, and equity make up the balance sheet and form the equation: A = L + E. The same account may also be used in a two-part transaction if there is an increase and a decrease of the same category. The double entry system categorizes transactions using five account types: Assets, liabilities, equity, income, and expense. The combined entry will be to increase telephone expense and reduce cash for the same amount.

The telephone expense account therefore increases $200. In this example, the business paid a $200 phone bill in cash. Cash is used for a variety of purposes such as: Equipment, investments, loan payments, expenses, and more. Cash is decreased $200 and another account is required to explain the source and purpose of the transaction. Let’s say $200 cash is paid from the bank. The double entry system is used to categorize all transactions in and out of the business. The combined entry will be to increase cash and increase revenue for the same amount. The revenue account therefore also increases $1,000. In this example, the business was paid cash for services performed. Cash can come from revenue (business operations), loans, investments, or cash back from returning an item. The other account will help explain the source and purpose of the transaction. As a rule we need another account to record the activity. To record the transaction, the cash account is increased $1,000. Let’s say a business receives $1,000 cash. The double entry system requires us to pick at least two accounts (places) to record a transaction. The result of using double entry accounting ensures that every transaction is classified and recorded. The process of recording transactions with debits and credits is referred to as double entry accounting because there are always at least two accounts involved. Debits are always presented before credits. A list of all transactions appears in the general ledger. The sum of debits and the sum of credits for each transaction and the total of all transactions are always equal. These entries makeup the data used to prepare financial statements such as the balance sheet and income statement.Įvery accounting transaction involves at least one debit and one credit. Once understood, you will be able to properly classify and enter transactions. The mechanics of the system must be memorized. Debits and credits form the foundation of the accounting system.

0 kommentar(er)

0 kommentar(er)